So much has changed in the last decade when it comes to selling excess or unwanted household items. Yes, of course there are still a few neighborhood garage sales being promoted here and there, and certain not-for-profits continue to conduct annual charity yard sales to fund their causes.

But even these previously tried and true methods for turning one person’s junk into another’s treasure are rapidly becoming a thing of the past.

The same holds true for consignment and antique stores. Many will not accept large pieces of furniture – especially those of the brown or upholstered varieties.

This trend leaves future downsizers wondering what they will do with their excess “stuff.”

“We are moving from a four bedroom home into a two bedroom apartment,” explains Martha Anderson. “Not only will I have too much furniture, but we have a shed, garage, and attic full of things that will need to be dealt with.”

Like Martha, many homeowners making plans to relocate intend to employ an estate liquidation company to help them turn their remaining items into cash.

“Once I have moved out, the estate sale people can simply get rid of what’s left,” said Henry Myers. “There are a number of items that should sell easily and bring in some profit.”

Despite what sounds like a simple solution to emptying a once overstuffed house, the estate sale industry is also undergoing changes.

Estate Sale Industry Experiencing Change

“Fewer people were buying used furniture and household goods for personal use at our sales. Due to the large resale market online, a lot of buyers are looking for deals so they can turn a profit themselves by reselling items on the internet,” says newly retired estate liquidator, Marny Tomilson.

“Certain trendy items still sell well, but of course trends change over time.”

Estate liquidators are being forced to become far more selective about the sales they take on and more creative in their approaches to marketing items for sale.

“Previously we would hold at least one sale every weekend all year long, but now our company is more selective about the sales we accept,” said Miles Shultz.

“It’s hard telling people they simply don’t have enough to make a sale worthwhile, but in the end it has to be a mutually beneficial arrangement for both them and for us.”

Online estate liquidation services are becoming popular in some regions of the country. Much like the traditional estate sale method, however, this type of sale isn’t a fit for everyone.

“Some people don’t like the idea of the starting bid being only $1.00,” says Liz Donnelly, online auction owner. “In an auction process, the market price is determined by what the buyers are willing to pay for an item.

Using this method, some items will sell for far more than we would have ever dreamed, while other things sell for less.”

Donating to Charity

Given the option of selling remaining items or donating them to a good cause, some downsizers would prefer to donate. Sounds easy enough, right? Well, maybe not.

“I had an upright piano that belonged to my aunt, as well as several really nice pieces of upholstered furniture and a hardwood dining table and chairs,” said Tony Mills.

“I called six different non-profits and offered them up for free. They said they didn’t have space for them. Since my house was closing that week, I put it all in storage and now I am paying to keep stuff I can’t get rid of.”

When asked about the best way to deal with excess household items, Certified Senior Housing Professional, Dr. Nikki Buckelew, provided us with five considerations, especially for downsizers.

- Keep the value of used household items in perspective. With the exception of those collecting things like fine art, firearms, or expensive gems, the sale of the average person’s household belongings may be enough to pay for their move.

- If you aren’t going to have an estate sale or online auction, start letting go of things sooner than later. Give things you don’t use or want to someone who will use them or who will appreciate them.

- Remember that if you own your home, it is likely far more valuable than the contents. Holding on to a few hundred dollars worth of personal possessions can delay a sale and ultimately end up costing you thousands.

- Don’t assume that the new occupants of your home will want your furnishings (even if they are nice). Most of the time they won’t (even for free) and will want the home completely emptied before they take possession.

- One of the biggest obstacles for families dealing with estates is handling the personal effects. Due to time constraints, lack of resources, and the emotional toll it takes, people may put it off for months or even years. Sometimes the house has deteriorated and decreased in value as a result.

Passing It Down to the Children

Probably the most common misconception shared by those having recently moved into a smaller home has to do with which items (or lack thereof) their kids would like to have for themselves.

John and Susan Taylor thought they would help their grandkids outfit their new apartments as they went off to college. “All they wanted was the refrigerator and the outdoor chairs,” said Susan. “We tried to give them pots and pans, yard equipment, and other things, but they said they didn’t need it.”

Similarly, Bill Sparks was surprised when his son and daughter in law passed on taking the good dishes, silver, and antique furnishings he and his late wife had set aside for them.

“When they told me they didn’t have the room, I wasn’t sure what to say,” said Sparks. “I was glad my wife wasn’t here to be involved in the conversation. I am pretty sure she would have been heartbroken.”

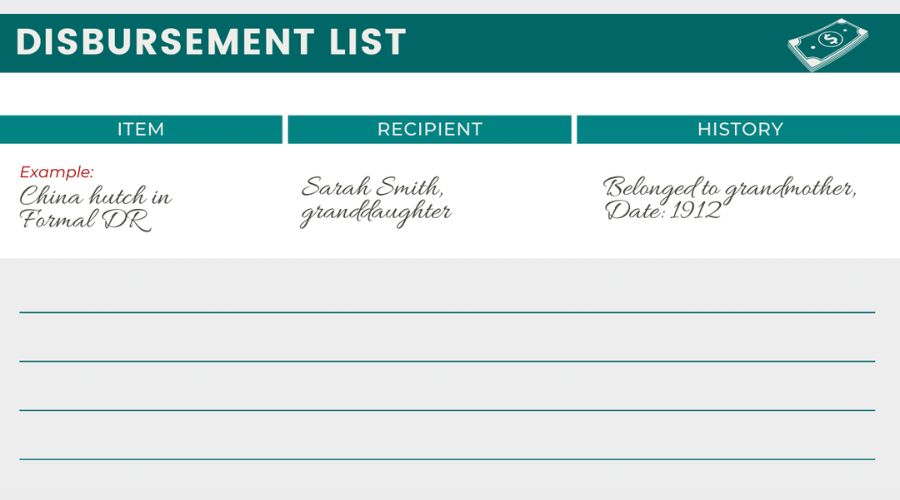

Planning ahead for the possibility of making a future move requires making plans for the disposition of household items too.

When involving others in the process, whether it be family members or professional service providers, starting earlier in the process is better than later.

Communication about expectations, understanding industry trends and gathering information in advance can not only save time, but may help alleviate unnecessary or unexpected stress.

If you or someone you know would like a complimentary downsizing coaching appointment, give us a call at 405.708.7010.

Planning a future move,

but just aren’t quite ready yet?

If you are a seasoned homeowner or someone

who plans to downsize from a larger home to a smaller

space in the next few years, you have come to the right place.

Click on the Button Below

to learn how you can join the Oklahoma Downsizers Club.